Happy New Year, everyone; we’ve made it through the first week! Have you made any resolutions for 2021? If not, you’re in luck. We’ve come up with four payroll resolutions you can make to feel confident about your payroll data as we move into this new year.

Resolution 1: Conduct a review of your account configuration that impacts payroll data:

Company taxes are key for successful payroll calculation and tax filing: Every new year brings new unemployment rate updates. Send rate notices to UKG as soon as possible, and we’ll help you change the rate within your account. If a rate change occurs after January 1, a reconciliation payroll must be processed to update any 2021 data.

For UKG Payroll Services clients, changes to company taxes will need to be submitted to UKG. If in Implementation, contact your Project Team. If in Support, open a support case by using the UKG Community portal or by calling +1 800 394 4357.

Another thing to look for are missing tax IDs. These are company tax accounts that have no tax ID entered or have the tax set to “Applied For.” Company taxes that are considered missing IDs create a large risk for clients. Many tax agencies will reject payments and/or returns when there is not a valid tax ID number. This can result in fines, penalties, and interest charged by the agency (some states charge up to 15%).

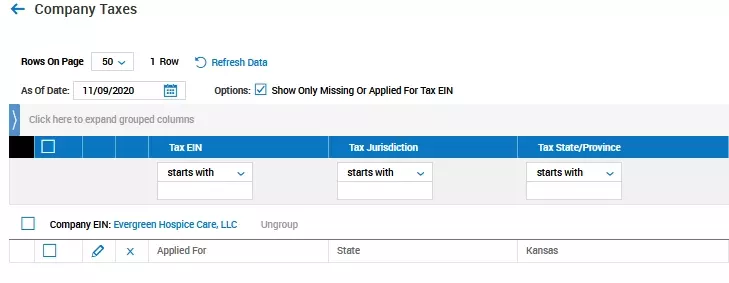

We want to make it easy to manage these types of company taxes, so to assist, we recently developed a quick and easy way to identify these taxes. You can find earning and deduction codes in your account by following this path: Admin >> Company Settings >> Payroll Setup >> Company Taxes >> Easily identify by using our new filter “Show Only Missing Or Applied For Tax EIN”

UKG Payroll Services offers many tools to help you review and understand your company taxes:

- Payroll Services — Company Tax Job Aid

- Payroll Services Mini Session — Company Tax Review

- Payroll Services: Quick Links to Tax Agencies

**Company taxes directly impact successful tax and payment filing. UKG Payroll Services clients must make all changes to company taxes through UKG.

Review earning and deduction codes settings: Make a point to review your active earning and deduction codes and make sure what will be used in the new year is applicable to your company and coded correctly for usage in new year payrolls. Within the Earning or Deduction page: Select Columns >> Add the following columns to the page W2 Box Type/1099 Box Type. Make any necessary changes. It is also best to inactivate any codes that will no longer be used. You can find earning and deduction codes in your account by following this path: Admin >> Company Settings >> Payroll Setup >> Earnings/Deductions

Reminder on 2020 earning codes related to COVID-19: If you paid out Families First Coronavirus Response Act (FFCRA) earnings during 2020, make sure those codes are inactivated in 2021. FFCRA paid family and sick leave expired on December 31, 2020. For more information on COVID-19, please visit UKG Kronos Community COVID-19 Resource Center.

Resolution 2: Check your employee information and setup:

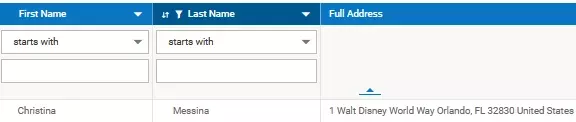

Employee names and addresses: Make sure employees’ names and addresses are accurate. Sending a reminder to your employees at the beginning of the year to check their pay statements and direct deposit vouchers for errors is best practice. Have your employees confirm their name is spelled correctly. Look at those addresses! Often employees forget to update addresses after a move. We also have a quick tip for names and addresses: Diacritical characters (e.g., á, ñ, ü) should also be removed from employee names and addresses as they will cause issues with tax filings.

Employee names and addresses can be reviewed on your account following this path: Team >> My Team >> Employee Information >> Use employee name columns and full address

Social Security numbers: It’s always worth slowing down to enter employee data carefully. Social Security numbers (SSNs) are the perfect example. Incorrect SSNs will create issues with employee W2s and when filing tax returns and payments. You must enter the correct SSNs when adding new employees and verify that the numbers are properly formatted to match Social Security Administration (SSA) standards.

Key facts per the SSA:

- SSNs cannot begin with the following: 000, 666, or 9

- SSNs cannot be the following: 123-45-6789, 111-11-1111

- SSNs cannot have double zeroes for digits four and five, or end in four zeroes

Employee SSNs can be reviewed on your account following this path: Team >> Payroll >> Forms >> W2s >> Add SS# column

Tax elections: It’s also important to confirm that your employees are coded correctly. Consider the following code selection examples:

- W2 employee versus 1099 contractor: Review the employee tax type for your employee to ensure it is correct

- Taxable or block withholding (W/H) or exempt: Incorrect tax coding on an employee can cause discrepancies with wages and taxes for your company and for your employee

Resolution 3: Keep that payroll data in the green; run validation reports often!

Data validation: These reports help keep the health of your account in balance. Processing data validation reports monthly will help identify imbalances as well as corrections that may be needed. It can also help identify any incorrect configuration on your account, such as SUTA rates or employee-level setup issues.

Data validation reports are preloaded to your account. Access them by navigating to Team >> Payroll >> Forms >> W2s >> then click Saved: {System} for a full listing of reports. The reports will show you any known discrepancies for each type of data validation.

If you ever find a discrepancy in your account, please use the tools offered by UKG to correct it.

- Data Validation Variances - How to correct.

- Payroll Services Mini Session: Wage & Tax Audit Reports.

- Use the search bar at the top of UKG Community to search the many knowledge base articles available.

- If you ever find a discrepancy in your account that requires correction, please reach out to UKG for assistance. We’re happy to help. We would rather be proactive and walk you through the correction than risk additional issues happening in the future.

Resolution 4: Stay tapped into key resources and tools!

UKG Payroll Services quarterly training: Training is scheduled twice per quarter. Once it is scheduled, the information can be found in two locations:

- Posted within the system via Pop-Up Communicator (for admins logging in)

- Posted in the UKG Payroll Services Resource Center and UKG Payroll Services Community group

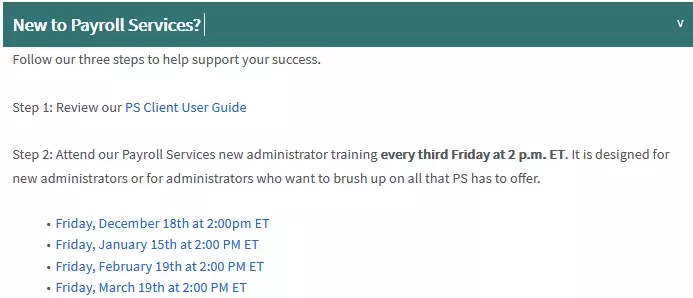

UKG Payroll Services administrator training: This is great for administrators who are new to Payroll Services. It’s offered on the third Friday of each month. Enroll here: UKG Payroll Services Resource Center >> New to Payroll Services?

Have any additional payroll resolutions you’d like to share? Make sure to post them in our UKG Payroll Services Community group and keep us updated on how these resolutions have helped your organization during the start of this new year!