As year-end approaches, you may be asking yourself if it’s normal for a payroll professional to cringe at the thought of year-end. The answer is yes, absolutely! Year-end is a very stressful time, with so many payroll tasks such as balancing and adjustments to complete and the lingering deadlines to meet — the thought of it makes me feel uneasy. But I’ll let you in on a little secret. Year-end DOES NOT have to be so stressful! I’ve come up with seven tips for payroll professionals to help guide you through year-end. Check them out below!

Tip # 1

Connect and engage with UKG

UKG is here to help you! Make sure you are a part of our UKG Payroll Services (UKGPS) group in the UKG Kronos Community to connect with UKG subject matter experts. We encourage you to join and set your notification preferences to follow along with “Every Post” on UKG Payroll Services Community Group.

Attend trainings! UKGPS will offer three Quarter- and Year-End Overview Session webinars as we approach year-end. Continue to visit the UKG Payroll Services Resource Center for session registration or to listen in on the prerecorded sessions.

*New* Year-End Overview Session: This webinar provides a high-level overview of year-end. This is best for those who need a quick refresher on year-end or for those who are new to the year-end payroll process. We will review important dates, tools, and high-level tasks to get you started!

Year-End Deep-Dive Session: This webinar provides a more in-depth review of year-end, including important dates, preparing for year-end, completing year-end tasks, and tools to use!

Tip # 2

Know where to find your tools and resources for year-end

The UKG Payroll Services Resource Center should be added to your browser as a favorite! During quarter- and year-end, the UKG Payroll Services Resource Center page is aimed at providing you with the first steps to take to kick off quarter- and year-end processes. This site is filled with great tools and resources for you to use throughout the year, such as:

- Mini Sessions: Short, on-demand video recordings that take you through important client tasks within the system

- Job Aids: One-page guides that provide instruction and best practices on client tasks within the system

- Additional tools for quarter- and year-end:

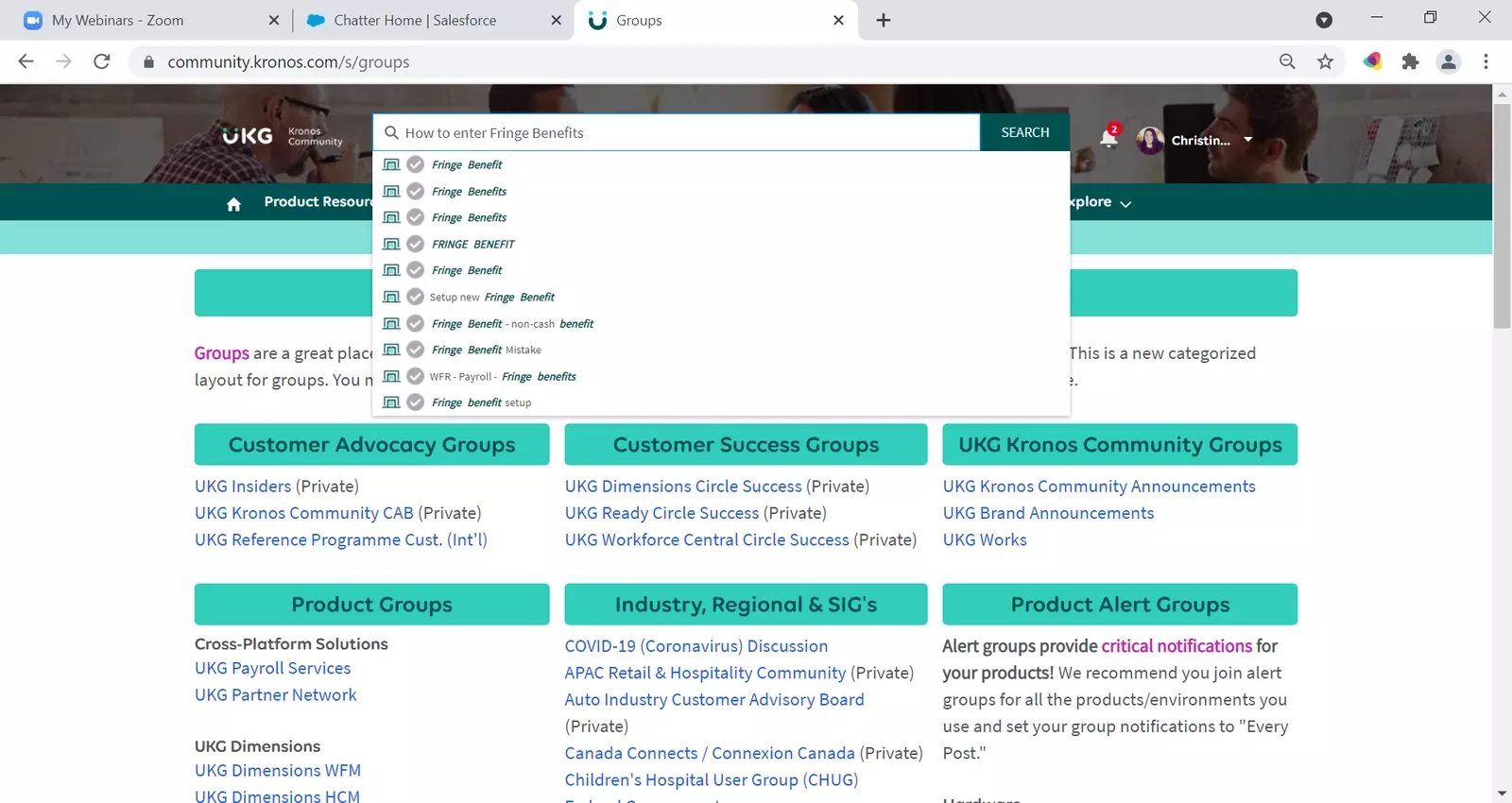

Other tools available on the UKG Kronos Community:

- UKG HR and Payroll Resource Library is a research tool for your HR and payroll issues

- In UKG Kronos Community, selecting “Learn” from the top menu bar will provide you with additional training information for your different modules

- Using the search bar at the top of the screen will provide you with knowledge base articles and other documentation

Tip # 3

It is never too early to map out quarter- and year-end tasks!

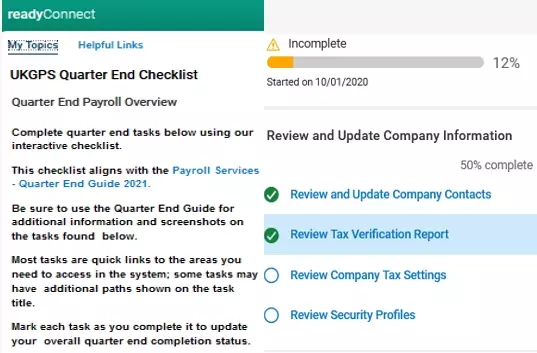

Start by reviewing the Quarter- and Year-End Checklists:

- For UKG Ready™ customers, the UKGPS Quarter- and Year-End Checklists are located right within the system by accessing your ReadyConnect panel >> My topics

Note: Must be logged in as a KPS company administrator or payroll administrator to access checklist

Next, map out a plan to complete all tasks prior to the quarter- and year-end deadlines. It’s important to note dates provided on the UKG Payroll Services Resource Center Important Dates matrix.

Tip # 4

Review your company tax accounts

Company taxes directly impact successful tax and payment filing:

- Unemployment rates: Review rates in the system against what is received by the state unemployment agencies. Send rate notices to UKG as soon as possible, and we’ll help you change the rate within your account.

- Missing tax IDs: Tax accounts should never remain in applied-for status or have a blank EIN field. This can risk mistakes in tax payments and filing. Learn more about which tax agencies will not accept returns or payments without valid ID numbers here: UKG Payroll Services: Taxes UKG Payroll Services Cannot Make Payment/File with Missing ID or Applied For Status.

- Identify client-responsible taxes to be filed: For UKGPS clients, there are some payroll-related taxes that UKGPS cannot support, and the client must file and pay them directly. A full list and guidance can be found here: UKG Payroll Services: Client Responsible Taxes.

*UKGPS clients must make all changes to a company tax through UKG by submitting a case. We will work with you to confirm the settings are accurate.

Tip # 5

Set aside enough time to reconcile your payroll data

*Being proactive here is key! Reviewing data can be the most time-consuming task when closing the tax year.*

- Confirm earnings and deductions are set to the proper W-2 boxes.

- Enter all third-party sick pay, fringe benefits, and any necessary payroll adjustments or reconciliation payrolls.

- Begin reviewing your data validation reports as outlined in Appendix A of the Year-End Guide. Also check out our Mini Session on Data Validations Reports — a shorter video session that takes you in the system and shows you best practices!

Did you know?

By incorporating data validation reports in your monthly process, you will eliminate time and work spent on reviewing and adjustments at the end of the quarter. And we have the tool — Healthy Payroll Checklist — that will help you achieve this.

Tip # 6

Wrapping up the tax year

Closing out the tax year

Closing and signing off on the tax quarter and the tax year are the final steps to mark year-end as complete! Closing and signing off tells UKG Payroll Services that you have reviewed your data and adjusted data and you are ready for tax filing to begin.

Not sure how to close & and sign off? Use our close & sign-off tools located on the UKG Payroll Services Resource Center, including:

- Mini Session: Closing & Signing Off (QTR/YR)

- PDF: Closing & Signing Off (QTR/YR)

- Closing & Signing Off Job Aid

Review your Tax Package

Tax Packages provide a paper version/copy of all tax returns filed and paid on your behalf by UKG Payroll Services. Tax Packages are loaded to your account on or before the 20th of the month following the end of the quarter.

It is very important to review your Tax Package to confirm you see all expected returns and they reflect the data you expected. UKG Payroll Services offer tools to help you better understand the Tax Package and how to research variances:

Tip # 7

Ask for help!

Asking for help can be hard, but throughout year-end preparation, please remember we are here to assist you!

Ways to receive support:

- Crowdsourcing is a great way to connect with subject matter experts and peers within the UKG Community. UKG Community has several groups that can assist you.

- UKG Community also offers a smorgasbord of wonderful tools and resources. As mentioned earlier in this blog, the UKG Payroll Services Resource Center is aimed at quarter-end and year-end success.

UKG Community also provides a full content library of knowledge base articles to guide and instruct you on system processes. Using the search bar at the top of the screen will provide you with access to the topics you are looking for.

- If at any point you are not sure of the next action or need assistance in the system, please contact our Support teams by selecting the option found on UKG Community >> My Cases