It takes more than technology or just HR, payroll, and workforce management solutions to put an organisation on the right path. It takes combining those solutions with the kind of guidance and partnership that leads to cultures of trust and belonging.

HR, PAYROLL, & WORKFORCE MANAGEMENT SOLUTIONS

Our purpose is people

Inspiring every organisation to become a great place to work through HR, pay, workforce management, and culture technology built for all.

Global operations in service of people

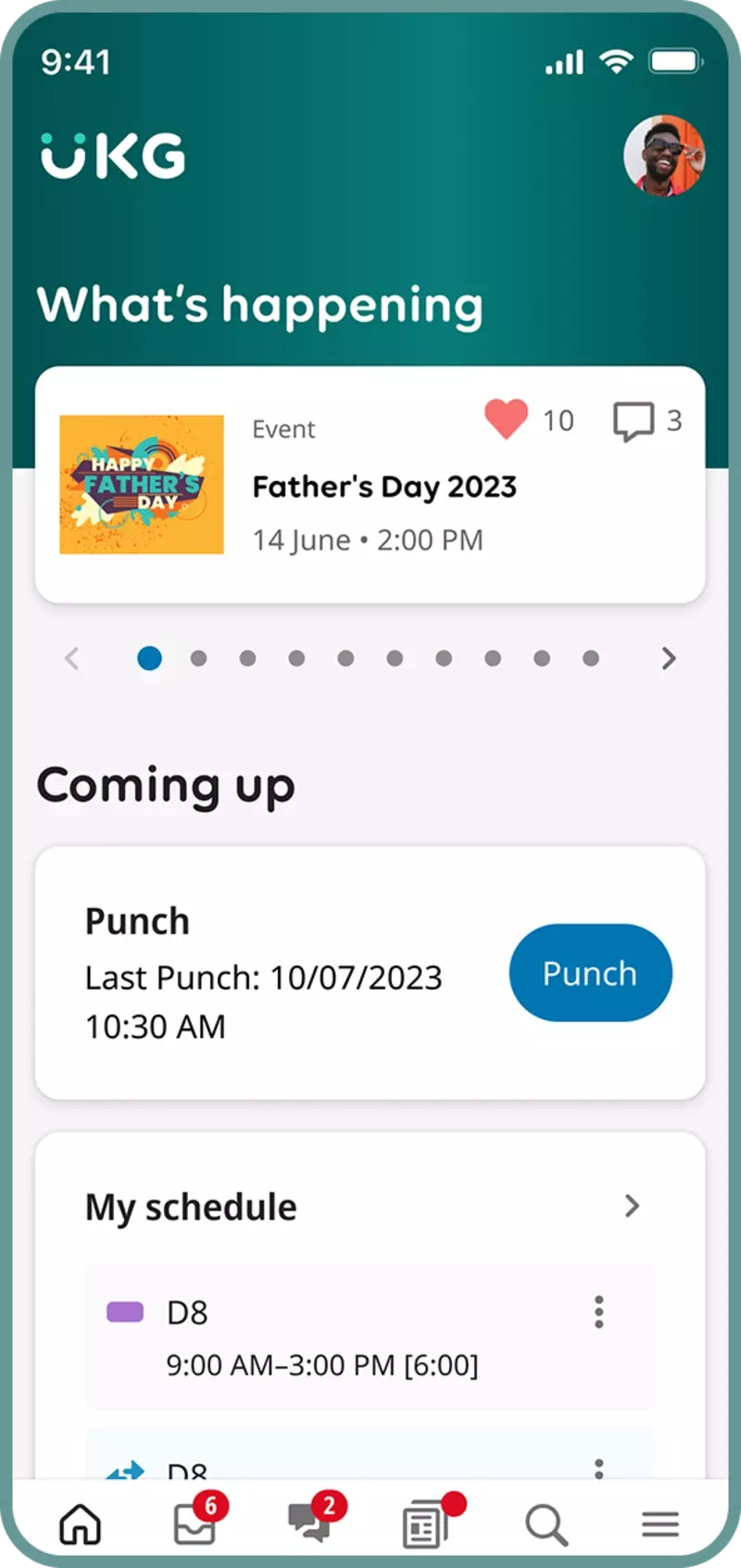

Our AI-powered workforce management tools help you streamline time and attendance, optimise scheduling, and create a workplace where your people thrive.

Purposeful HR that guides and empowers leaner teams

The all-in-one HR solution designed to make your team's life easier by simplifying payroll, talent, and time management.

Connect culture insights and business outcomes to realise what's possible when you invest in your people.

Build great experiences with solutions designed for all people and roles — meeting employees where they are on their journey.

Experience service that accelerates value, promotes confidence, and ensures long-term success.

Create great workplaces for all with our HR, payroll, and workforce management solutions.