Congratulations! You’ve officially submitted payroll. Don’t worry. UKG Payroll Services (UKGPS) will take it from here. We’ll finalize your payroll and deliver the post-processing services your organization has selected.

But don’t sit back and kick your feet up just yet. There are a couple of things you can do that will improve your post-payroll submission experience.

Check out these five best practices we recommend making part of your standard payroll process. These suggestions are by no means mandatory, but adopting them can alleviate stress surrounding what comes next.

1. Stay in the know with key communications from your UKG Payroll Services friends.

Did you know there are three primary emails that will come from your UKG Payroll Services team after you submit payroll? Keep your eye out for the following three communications:

- Payroll has been finalized email notifications: When UKGPS finalizes your payroll, the administrator indicated as the payroll contact on your account will receive a “Payroll Has Been Finalized” email. This email instructs you to review your Payroll Recap and Funding Report for the finalized payroll. More about this report in the second best practice.

How can you confirm who is designated as the payroll contact on your account?

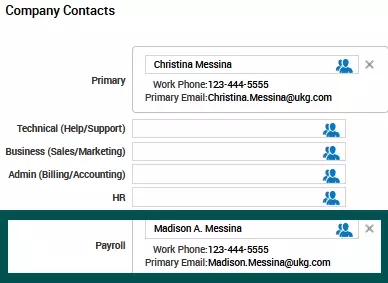

Payroll contacts are visible within your account in the UKG Ready and UKG Dimensions HCM solutions. You can confirm who your payroll contact is by following this path:

Admin >> Company Settings >> Global Setup >> Company Setup >> Company Info Tab – Company Contacts widget

- Funding email notifications: Once payroll is finalized, be on the lookout for any funding notifications. If funding has not been received by 4:30 p.m. ET on the day your payroll is completed, your UKG Payroll Services team will reach out to the payroll contact. The best action is to contact the bank to verify that the funding request is being processed.

- Shipping provider email notification: Your designated shipping provider (FedEx/UPS) will send you an email notification once your payroll package has been prepared. If you do not receive the shipping label confirmation email by 4:30 p.m. ET on the day your payroll is finalized, please contact UKG.

2. Always review your Payroll Recap and Funding Report.

The Payroll Recap and Funding Report displays all payroll payments by funding source and provides an overview of a given payroll. You should immediately review this report once you receive the payroll finalization notification email. This report will tell you the final amount needed to fund your current payroll. You can find this by locating the “Kronos Payroll Services Debit Section” on the report. Do not deduct voids from the Kronos Payroll Services Debit, as those are returned separately via ACH.

Where can you locate the Payroll Recap and Funding Report?

Find the Payroll Recap and Funding Report in the payroll system by following this path:

My Reports >> Payroll >> Payroll Recap & Funding

3. Take your time, grab a coffee, and review your payroll package.

Once you receive your payroll package, open the package right away! Review your package to ensure all checks have printed as anticipated. If you locate any discrepancies, reach out to UKG immediately. We will work with you to resolve any issues. Remember not to hand out paychecks before the pay date so they are not presented for early cashing.

How do I know where my payroll package will go?

Payroll packages are delivered to the address that is in your Delivery Policies within the system. These Delivery Policies tell Payroll Services where to send your payroll packages. Review your Delivery Policies by following this path:

Admin >> Company Settings >> Profiles/Policies >> Delivery Policies

4. Utilize the Tax Wage Details Report.

The Tax Wage Details Report is a crucial resource and should be your number one tool used after each payroll submission. This report shows all current payroll tax wages and liability. Adding this report to your payroll checklist or using our new UKGPS – Healthy Payroll Checklist will help keep data clean and balanced. It will also reduce those not-so-fun payroll surprises.

Reasons to run the Tax Wage Details Report:

- Identify all current wage and tax liability for the period

- Review for new or unexpected taxing jurisdictions

- Quickly balance for flat-tax percentages, including FICA/MEDI/FUTA/SUTA

- See many available column options, including employee detail

- Use to capture data for client-responsible taxes

Where can you locate the Tax Wage Details Report?

Locate the Tax Wage Detail Report by following this path:

Team >> Payroll >> Reports >> Taxes >> Tax Wage Details Report

You can customize the report by bringing in the columns you want to review.

*User Tip: Once you customize the report, be sure to save it as a VIEW for future use!

5. Rotate Data Validations Reports after each payroll.

Data Validation Reports are used to review payroll data. They will help locate current data discrepancies or company-/employee-level setup issues. Adding these to your after payroll process — or, at a minimum, running them for a couple of months — will help your account’s data accuracy. We recommend clients run data validations each month to confirm their data is accurate and balanced. Clients can find data validation instructions in the UKG Payroll Services Quarter End Guide > Appendix A.

Examples of data validations:

- Verifying Social Security numbers

- Reviewing for negative amounts (could be wage, tax, or benefit)

- Confirming no wage bases have been exceeded

- Balancing wage against tax (wage X tax)

Looking for more information on data validations? Check out these tools:

Payroll Services Mini Session: Data Validations Reports

Data Validation Variances Job Aid

Don’t forget to check out the UKGPS – Healthy Payroll Checklist — the new tool providing UKG Payroll Services clients with best-practice steps to take after each payroll. Examples include verifying wages and taxes and rotating important Data Validation Reports to keep payroll data healthy at all times.

Continue to follow along with us on our UKG Payroll Services Community Group and the Payroll Services Resource Center.