A new year is always exciting! It is a clean slate to start over — a fresh start. Most of you set personal goals at this time, but you can also set professional goals. If you are a payroll professional, now is the perfect time to hit reset and start the year prepared. Setting goals for a healthy payroll year is possible. And it’s not too late to get yourself on track for a successful quarter and year-end!

Christina Messina, Program Manager for UKG Payroll Services, discusses six important annual checkup tasks to keep you on track.

Task 1: Plan out your year — review your pay period and check dates

As you embark on your new payroll year, it is essential to review your payroll calendar. It’s in your best interest to confirm the start and end dates for your pay schedule and the payroll check dates. Take special consideration around the company and banking holidays. The application has rules that will allow your pay period schedule to move dates for you automatically. Knowing these settings and confirming your dates are important pieces to success in this new year.

In UKG Ready and UKG Dimensions HCM

Admin > Profiles/Policies > Pay Periods

- Enter the Pay Period Profile for review, locate the Pay Period widget, and then use the Start Date, End Date, and Pay Date columns to verify the accuracy of the settings.

- Is a change needed? Reference this knowledgebase article for assistance.

- Missing pay dates? Reference this knowledgebase article for assistance.

Task 2: Confirm your earning and deduction codes are set up as expected

A quick review of the earning and deduction codes you plan to use in the future is a best practice. Confirm reporting settings (such as the W-2 form boxes) are applied, and with any custom code, verify the confirmation of taxation and reporting is accurate.

You can easily do this within the application by adding a few columns to your Earning/Deduction screens.

In UKG Ready and UKG Dimensions HCM

Admin > Payroll Setup > Earning/Deduction Codes

- Add columns to review, such as W-2 Box Types and W-2 Box 14 Description 1099 Box Types.

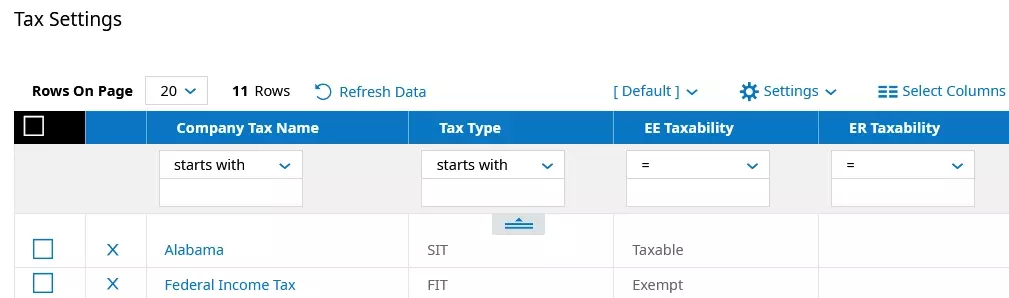

- For custom codes, select the blue pencil icon to open the code for a full review. Look at things such as the Earnings or Deductions “type widget.” And most importantly, review the Tax Settings widget, which will display the custom set taxability for federal, state, and local taxes.

Made a change to Earnings or Deduction Code settings? Reference this article to confirm all steps were completed.

Task 3: Company taxes are vital for successful new year filing

The new year will come with unemployment rate changes. As you begin to receive the rate change notices, be sure to send them to UKG as soon as possible, and we’ll help you change the rates within your account. If a rate change occurs after January 1, a reconciliation payroll must be processed to update any 2022 data.

Another thing to look for is “Missing Tax IDs.” These are company tax accounts with no tax ID entered or ones that have the tax set to “Applied For.” Company taxes that are considered missing IDs create a significant risk for clients. Many tax agencies will reject payments and/or returns when there is no valid tax ID number. This can result in fines, penalties, and interest charged by the agency (some states charge up to 15%).

Many tools/resources are available to assist with managing company taxes. Here are a few we would like to share:

- Company Tax Job Aid

- Company Tax Mini Session Recording

- How Do I Register with Tax Agencies?

- Client Responsible Taxes

*For UKG Payroll Services clients, changes to company taxes will need to be submitted to UKG. If in Implementation, contact your project team. If in Support, open a support case by using the UKG Kronos Community portal or calling +1 800 394 4357.

Task 4: Encourage employees to review their first 2022 pay statement

It is important for employees to review their pay statements for errors. Errors on employee pay statements affect the employee and can also impact the employer.

So, what should employees verify on their Pay Statement?

- Confirm personal information correctly reflects:

- Name

- Address

- Identifiers such as the last four of the Social Security number (SSN) or Employee ID

- Tax election

- Confirm pay and hours:

- Are the pay and hours correct for the pay period?

- Confirm taxes withheld:

- Do you have federal withholding? If you should, and taxes are not being withheld, report it.

- Are the correct state and local taxes being withheld?

- Please report any incorrect or under-withholdings, as they will impact your personal returns.

Task 5: Healthy data checkups each month

Keep your 2022 data healthy by reviewing Data Validation reports frequently. Data Validation reports will help you identify discrepancies and imbalances with your data. We recommend that you review these reports monthly, at a minimum, to reduce the need for corrections or issues that could snowball into bigger problems!

In UKG Ready and UKG Dimensions HCM

Team > Payroll > Forms > W-2s > Select “Saved” dropdown to access reports

The following reports are available to you and will only deliver results for current discrepancies that must be addressed:

- Federal Wages on W-2 are zero or negative

- Box 1 VS Box 16 (Federal VS State Wages)

- Social Security is over wage base limit

- W-2 Audit Box 4 (Social Security Taxable Wages VS 6.2%)

- W-2 Audit Box 6 (Medicare Taxable Wages VS 1.45%)

- W-2 Address Audit

And while you are in your W-2 Forms screen, it is also an excellent practice to check for any invalid Social Security numbers. Invalid Social Security numbers significantly impact the process of filing tax returns, the ability to generate employee W-2 forms, and the submission of unemployment claims.

It’s crucial you understand the risk that comes with an invalid Social Security number:

- Incorrect data filed with agencies

- W-2Cs will be required when an incorrect SSN is on issued forms

- Unemployment claims can be denied when the correct SSN is not recorded

- SSNs cannot be filed with the Social Security Administration and will be removed from the filing, which can impact your employee’s ability to file their personal tax returns

To verify SSNs, add the “SS#” Column to the Forms > W-2s screen and filter using the invalid criteria below:

- Cannot begin with: 000, 666, 900-999

- Cannot be any of the following: 123-45-6789, 111-11-1111, ***-00-****, ***-**-0000

- Cannot have double zeroes for digits four and five, or end in four zeroes

*Connect with your employee immediately if you confirm they have an invalid Social Security number within their profile. Updating that information is vital to your tax filings and the employee’s reporting.

There are many tools available to assist with managing data. Here are a few we would like to share:

- Data Validations Mini Session Recording

- Data Validations Job Aid

- UKGPS Quarter End Guide (refer to Appendix A)

Task 6: Start proactive habits — add important reminders to your calendar now!

- Daily: Follow along with Community Groups such as:

- Monthly: Add Data Validation reminders to your calendar. Setting those up as a recurring event will help keep you in check for the entire year.

- Monthly: Correct employee data is just as critical as the numbers being reflected in your reports. Reviewing employee names, addresses, and Social Security numbers will help tie everything together for 2022.

- Quarterly: Attend quarter-end training throughout the year to “stay-in-the-know.” Training sessions can be found on the UKG Payroll Services Resource Center.