Just as the workforce is adjusting to the “new normal” of living and working with Covid-19, organizations and their employees are learning to navigate a high-inflation market and potential recession concerns. This affects everyone at work, from employers to employees, when it comes to pay, benefits, in-office vs. hybrid work, and more.

We’ll look at how recent events have shaped the economy, how the economic outlook may impact your company, and share steps employees can take to prepare themselves for uncertain times.

The pandemic and Russia’s impact on the economy

We are currently experiencing the pandemic’s fluctuating effects on the economy. During the beginning of the pandemic, unemployment rose sharply, and economic concerns paired with stay-at-home mandates caused spending to drop sharply. The government artificially pumped money into the economy to facilitate consumer borrowing and spending to prevent the economy from entering a recession.

Supply chain and staffing issues caused demand to skyrocket, enabling many companies to increase their prices on products and services. It’s been challenging for manufacturers (as well as those in the hospitality and travel industries) to keep up with the rapid changes in supply and demand. According to the White House, “between May 2020 and May 2021 prices of commodities tracked within the Producer Price Index rose by 19%.” This is the largest increase since 1974.

Russia’s invasion of Ukraine worsened the problem. Russia has the world’s largest gas reserves and is the world’s largest exporter of natural gas. Many Western countries and companies halted or limited new purchases of oil and gas from Russia in a form of “economic warfare,” and these sanctions have had significant and predictable consequences. Oil and commodities prices rose drastically, followed by gas prices. Higher gas prices then led to an increase in transportation costs, specifically for food. Currently, food prices are rising to the extent that many individuals are worried about providing for their families. Kim Peyser, Deputy Assistant Secretary for Administration at USDA, found that more than 38 million Americans experience food insecurity today.

Ukraine and Russia are also important agricultural producers for the world, and Ukraine’s production has reduced dramatically. The Food Price Index is now at its highest level since 1990, including dramatic hikes of staple food items like bread and eggs. Low-income workers are particularly struggling to make ends meet, with few opportunities to “cut luxuries.”

What’s happening now

Following its initial drop, the economy has grown at a rapid rate throughout the pandemic—so much so that it’s reached the other side of the pendulum and is having trouble stabilizing. What comes up must come down, so to speak—and according to historical averages, we were technically overdue for a recession even before the pandemic began.

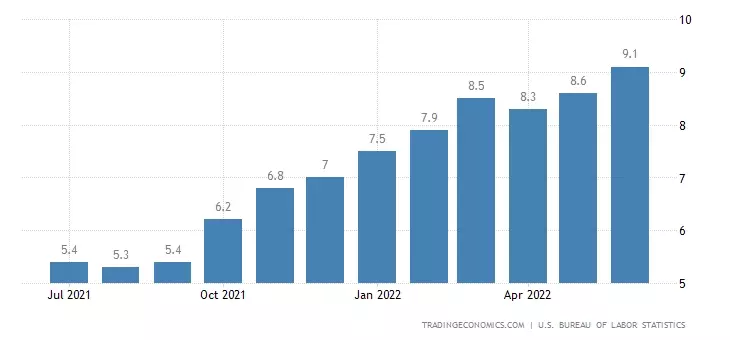

We can look at the inflation trends to anticipate where the economy is headed. Inflation does not directly cause recessions, but when the Fed increases interest rates to control inflation, this can inadvertently spark a recession. As shown in these charts by Trading Economics, inflation has increased greatly over the past year.

The June Consumer Price Index, which measures changes in the price of food, housing, gas, and other necessities as well as discretionary items, rose 9.1% over the past 12 months—a 40-year high. These price increases are affecting businesses and people in many ways. Many employees are seeing wage increases, but they’re simply not enough. In a survey of U.S companies, employers are budgeting for an average wage increase of 3.4% in 2022—approximately half of the inflation rate. Families from all backgrounds are feeling the pressure to adjust their budgets and plan for a potential recession, which means less discretionary spending on the products and services most businesses sell.

What this means for business

We have seen dramatic shifts in the workplace throughout the pandemic. The “war for talent” gave workers a lot of leverage in terms of wages, remote work, flexibility, and other benefits. Recessions typically lead to slower job growth, layoffs, and a power switch back to employers. Is that where we’re headed?

If so, we don’t expect it will last long. Employers of choice will continue to prioritize their employees during this time, recognizing the significant impact this support has on productivity, retention, and an employer’s brand. Companies can alleviate some financial stress by allowing people to work from home if it is not necessary to come in. This is also a great time to consider financial wellness benefits and financial support tools, such as same-day pay.

An economy that is cooling off reduces the bottom line for many companies, and fiscal responsibility is paramount. However, employers who can afford to increase benefits, wages, and additional support should do so, as this helps solidify employee trust. Companies that are concerned about growth and revenue should consider low- or no-cost ways to support their people where possible and help them grow both their careers and skillsets at a time when external hiring may be slowed or frozen.

Steps employees can take now

For individuals, getting a clear understanding of your own financial situation is paramount. Budgeting is a great place to start, and good habits now can benefit you for years to come. Some things, such as gas prices, are out of our control, but you can make daily changes to your lifestyle to protect you and your family during these high times of inflation. Here are a few places to start:

- Shop smart at the grocery store. Create a food budget and prioritize lower-cost items. Meat prices are increasing more than fruits and vegetables, so create healthy alternative meal options. Focus on what’s in-season and on sale. Consider buying in bulk when there’s a deal on frequently used staples. Purchasing from farmers markets is often cheaper since most of the food is grown locally and doesn’t include transportation costs from around the country (or the world). Frozen and canned goods are also economical. Now is a great time to experiment with buying cheaper alternatives.

- Aim to save at least three to six months of household expenses in an emergency fund.

- Be critical of new and existing debt. In a world where every electronic, clothing item, and toy can be charged or purchased with just “10 low payments of … ,” recognize that the average interest rate for new offers is higher than 19%. This means you’ll essentially pay $119 for what would have cost $100 if you had paid cash. Pay off existing debts and avoid new ones if possible.

- Save money on gas by carpooling or using public transportation. If your job allows you to be remote, work from home when possible. If you do not have that option, speak with your employer to see how they can help you.

- Consider a second part-time job or look for other opportunities to create multiple streams of income.

- Continue investing in your 401(k), if possible. Avoid viewing your 401(k) as an emergency fund; avoid withdrawing your capital at all costs. Time in the market is your friend, and the biggest losses come from people withdrawing their funds prematurely or trying to “time the market.” Additionally, check to ensure your funds are diversified.

- If you own a home, explore a cheaper interest rate to bring your mortgage payment down. Speak with your mortgage company to discuss ways you can work together.

Although most of what is happening or predicted to happen is out of our control, there are daily changes we can all make to prepare. Employers, leaders, and employees must continue to work together to support one another as we navigate this constantly changing world.