Not only is physical health a priority for all employees right now, but financial wellness should also be a priority. Studies show that keeping employees financially healthy can even help keep them physically healthy as well.

Financial wellness means many things to many different people. For some, it may mean being able to put money aside for retirement. For others, it may just mean paying their rent on time. Even before this pandemic, the state of the hourly workforce was less than ideal. Many hourly workers were living paycheck to paycheck—and now, that financial instability has only been heightened.

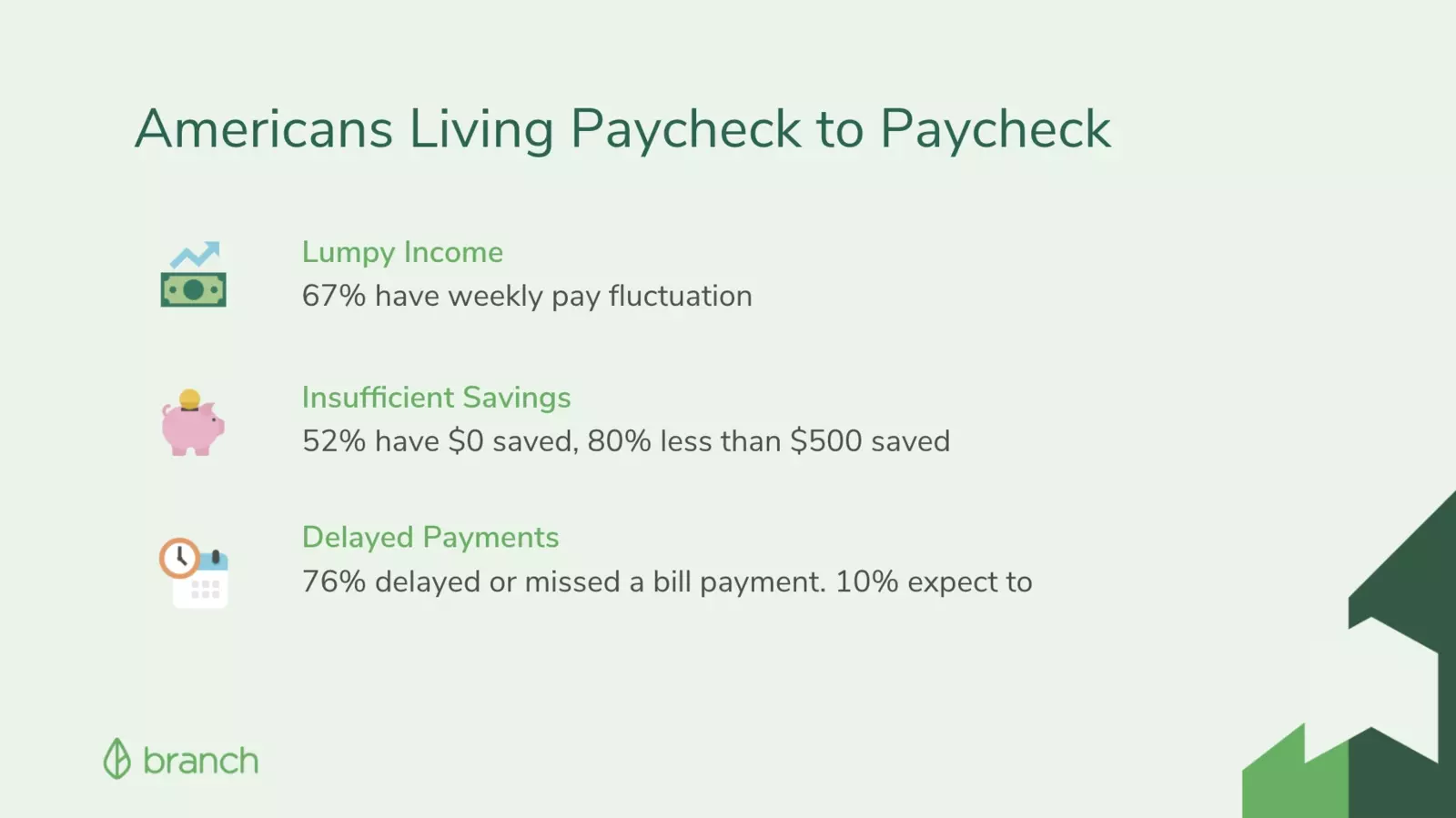

In our 2020 Branch report, we surveyed more than 3,000 hourly workers across a variety of industries. We wanted to get a sense of how their financial concerns and priorities had shifted over the first half of the year. What we found was that hourly workers are struggling. The majority of workers have weekly pay fluctuation, making it difficult to plan accordingly and leading to an inability to plan and save. Because of this, 80% of hourly workers had less than $500 saved for an emergency. And even with stimulus checks, 76% of employees say they’ve needed to delay or miss a bill payment in the past few months.

These statistics can be disheartening, but there are ways your company can help your employees—without costing you any additional spend.

With so many hourly workers struggling, employers are uniquely poised to help them bridge the gap between living paycheck to paycheck and beginning to get themselves out of debt and onto the path of financial wellness. You have the power to offer your hourly workers meaningful financial benefits they likely cannot access anywhere else.

Typically, we think of meaningful financial benefits as traditional 401(k)s, health savings accounts, or tuition reimbursement. These are great options but aren’t usually offered to hourly workers. Plus, traditional benefits aren’t always fully inclusive, especially of those who are unbanked or underbanked.

Here are 4 easy ways to empower your employees and assist on their path to financial wellness:

1. Allow for faster, flexible pay

In our survey, 94% of people said that flexible pay options would help ease financial burden and make them feel more confident about their finances. To help with this, look into implementing Earned Wage Access (EWA). Through these programs, employees can access wages for hours they’ve already worked ahead of payday. This helps your employees be more prepared for their bills and have a fallback for any emergencies, ultimately helping them get out of the rut of living paycheck to paycheck.

2. Provide easier, digital tips and reimbursements

Traditionally, tips, mileage, and other reimbursements have either been paid out in cash or put onto a bi-weekly paycheck. As the world moves further away from cash usage, it is becoming more difficult to tip employees. And, for many, waiting for a paycheck to get tips and reimbursements can break their budget. Instead, look at solutions that allow you to tip and provide one-off payments digitally, outside of the traditional compensation structure. This gets your employees their money faster and it can make handling reimbursements easier on your payroll team as well.

3. Support financial wellness with education and budgeting tools

Education can happen in many ways. First and foremost, make sure your employees are aware of their benefit options and understand how to leverage them. Then, look into employer-sponsored tools that help your employees track their finances and better budget for their expenses. Offering budgeting tools as a free benefit pushes your employees down a solid financial path.

4. Sponsor fee-free banking

Finally, consider employer-sponsored banking options. Traditionally, we have expected our employees to be banked outside of work. But the reality is, most banks have fees and minimums that the majority of our hourly workers cannot keep up with. Thanks to technology and challenger banks, you can easily offer your employees fee-free options, including checking accounts, debit cards, and ATM access—all at no cost to you or your workers.

There are some financial wellness tools that offer all of these: earned wage access, instant pay of reimbursements, budgeting tools, and fee-free banking. These benefits not only allow your employees to be financially empowered, but they can actually help your organization as well. Companies offering financial wellness benefits tend to see higher employee engagement, satisfaction, and increased productivity, which leads to reduced turnover. This creates a strong work environment and saves your organization time and money in the long run.

Financial wellness benefits create a win-win scenario for you and your employees. And the best news? All of this is easily available to you, at no cost, through the Branch and Kronos, soon to be known as UKG (Ultimate Kronos Group) beginning Oct. 1, partnership. Learn more about Branch here.

The content from this blog is courtesy of Charlie Kleiner, Field Marketing Manager- Branch. Helping working Americans grow financially. To learn more about Branch and Kronos partnership, visit their marketplace page.